Amazon has become one of the world’s biggest online marketplaces, allowing a world of shopping possibilities in just a few taps. And while most transactions go perfectly well, there are those occasions when things don’t quite work out. In that case, it’s good to know their return policy.

Read on to learn how to return items to Amazon and get a full refund. We’ll also explain how you can reimburse any customs charges if you return an Amazon order to a retailer abroad.

How to return an Amazon order

We love Amazon for its straightforward returns policy – customers can return their order for nearly any reason within 30 days from the delivery date and get a full refund.

If you want to return any items purchased directly from Amazon, here’s what you need to do:

- Visit the Amazon Online Returns Center, select the items you wish to return from “Your Orders,” and then click “Return Items.” You will need to provide the reason for the return and your preferred return method.

- Print out the Return Label or QR code and return authorisation. Then pack your goods and ship via your preferred courier. You can also drop your return at the Amazon locker.

There’s one caveat.

If you’re buying from a seller who uses Amazon (rather than directly from Amazon itself), things can get a little more complicated. They might have their own return policy. It’s always worth checking the seller’s terms and conditions before you buy something, just in case.

Amazon makes returns pretty easy, but we’ve seen quite a few of the same questions come up over the years, which deserve a little more love.

Here are the most frequently asked questions about Amazon returns.

How do I get a refund from Amazon?

Amazon can only refund you the cost of the returned item. You can choose the preferred method in the Online Returns Center.

All refunds are based on the Amazon Return Label. You’ll need to mark what item or items you’re returning correctly. This is why returning multiple items from different orders in one package isn’t a good idea. It could take Amazon a while to work through the discrepancy.

How long do refunds take to process?

Processing returns generally takes about 3 to 5 business days after the courier delivers the parcel to the Amazon Returns Center. In some cases, the return can take up to 30 days.

How long does it take to get a refund?

The refund time depends on the chosen refund method.

If you want your refund on your Amazon Gift Card, the money will be on it in 2 to 3 hours. Receiving the refund on your debit card can take up to 10 business days.

You can check the refund time in the table below.

| Refund Method | Refund Time (After Refund Is Processed) |

| Credit card | Three to five business days |

| Amazon.com Gift Card | Two to three hours |

| Debit card | Up to 10 business days |

| Checking account | Up to 10 business days |

| SNAP EBT card | Up to 10 business days |

| Gift Card balance | Two to three hours |

| Promotional Certificate | No refund issued |

| Shop with Reward Points | Up to five business days |

| Pay in Cash (at a participating location) | Up to 10 business days |

| Pre-paid credit card | Up to 30 days (depending on the issuer of the card) |

Can you get a partial refund?

You can receive a partial refund for certain items. Here is what you need to know:

- You may receive 80% of the item price if you’ve returned items in their original condition after the 30-day return window

- You can get 50% of the item price if you’ve taken CDs, DVDs, cassette tapes, or vinyl records out of their plastic wrap before returning them (yes, people still buy these!)

- You can get up to 50% of the item price on damaged items, items with missing parts, or signs of use that Amazon or the seller didn’t make.

What if you’re returning items abroad?

UK citizens and permanent residents must pay customs charges for importing goods worth over £135.

These fees can sometimes be high, and unfortunately, you can’t avoid them if you would like a courier to deliver your order.

But the good news is that if you return an item to a retailer abroad, you should be able to get a refund of customs duty and import VAT.

Import or customs duty is a tax levied on goods brought into the UK from abroad. This tax rate is not fixed – it depends on the value, type, and origin of the goods.

In some instances, you won’t even be charged import duty. For example, even if your order is above £135, but the items are manufactured in the EU, you won’t be charged customs duty. Score!

The second refundable fee is import VAT. On international orders above £135, you’ll be charged VAT at the rate of 20%. There are no exceptions to this rule; even for goods manufactured in the EU, you have to pay this fee.

If you aren’t sure how much you have paid for import duty and VAT, you can quickly check using our Import Duty Calculator. Just enter the type and value of your goods, and it will give you an estimated breakdown of customs charges in a few seconds.

Bear in mind that some fees are non-refundable even if you return items to a seller abroad.

Non-refundable customs fees

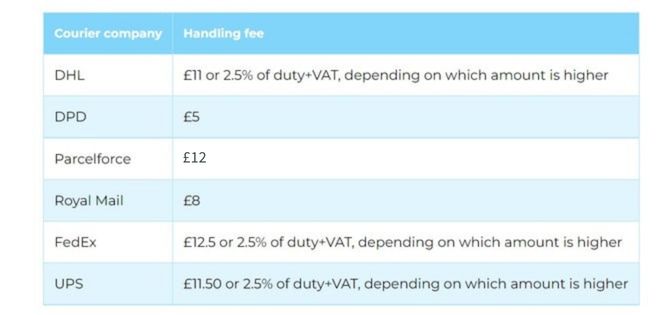

The courier company charges the handling fee for their customs handling services. Once your parcel arrives in the UK, the courier will handle the customs and pay the costumes charges on your behalf.

Once you pay back customs charges and a handling fee, you’ll receive your package. Since the courier company collects this fee for their services, it’s non-refundable.

Handling fees vary depending on the delivery company; you can see the standard rates below.

Excise duty is charged on importing excise goods, such as alcohol and tobacco. These goods are classified as excise goods, and higher rates apply.

In case you return excise goods to Amazon or any other retailer abroad, you won’t be eligible for a refund of customs charges for these types of items.

How to reclaim customs charges with Duty Refunds

Duty Refunds’s mission is to make international online shopping easier and time-saving for all UK citizens. We do this by helping with the complicated process of reclaiming customs charges once you return the items to the international retailer.

Our service is efficient, transparent, and hassle-free. You can get your money back from the comfort of your home.

To initiate a claim, go to our website and fill out the New Claims Form. Once we take a look at your submission, we’ll know whether you’re eligible for a refund or not.

Key takeaways

Returning orders on Amazon is possible 30 days after delivery. If you returned items bought from Amazon abroad and your order was worth over £135, you should be able to reclaim customs charges.

Duty Refunds can assist you in this process!

We have successfully processed hundreds of claims. Our average refund is £250. Our experts will handle everything on your behalf and make it hassle-free. Join our satisfied customers by filling out our online form!